・Basic Principles on Responsible Investment ・Domains of contribution to well-being

・Responsible Investment Report ・ESG Investment ・ Stewardship activities

・PRI Assessment ・Governance ・External Initiatives

Asset Management

Sumitomo Life manages assets with safety and security in mind so that we can continue to reliably pay insurance claims and benefit payments to our customers into the future. As the existence of a sustainable society is a prerequisite, we engage in asset management that takes into account sustainability over the medium to long term, including ESG (Environment, Social and Governance) factors(responsible investment)

Safe and secure asset management

Sumitomo Life applies Asset and Liability Management (ALM) considering the long-term characteristics of life insurance liabilities. Our basic policy is to secure stable earnings while controlling risks appropriately by investing mainly in long-term interest-bearing assets including public and corporate bonds and loans under ALM. Furthermore, we aim to sustainably improve corporate value by managing stocks and other risk assets within an acceptable risk amount.

Sumitomo Life Group's Initiatives under "Policy Plan for Promoting Japan as a Leading Asset Management Center"

Please refer here for details.

Sustainable asset management (responsible investment)

By

promoting responsible investment that takes into account ESG and other factors

that support

sustainability over the medium to long term, we aim to both contribute to the realization of a sustainable society as a responsible institutional

investor, and to ensure stable investment returns over the medium to long term.

【Actions】

Responsible investment specifically refers to ESG investment and stewardship activities.

| ESG investment | Stewardship activities |

|---|---|

| ・Investment that takes into account non- financial information including ESG factors in addition to financial information |

・Constructive and purposeful dialogue with investees and activities relating to the exercise of voting rights in accordance with the Japan’s Stewardship Code |

【Basic Principles on Responsible Investment】

It shows our approach with regard to responsible investment. We are promoting responsible investment under these principles.

Basic Principles on Responsible Investment

【Domains of contribution to well-being】

As an institutional investor, Sumitomo Life is committed to domains of contribution to well-being as indicated in "Sumitomo Life Group Vision 2030." The areas we focus on are listed below. We believe that by investing in these areas, we will also contribute to the growth of our business partners.

| Domain of contribution to well-being | Description | Related SDGs |

|---|---|---|

| Improvement of the Global Environment | ・An urgent issue for the whole world and an important issue that could cause damage to the asset value. We will encourage the transition to a carbon-free society through responsible investment. | |

| Contribution to Health Promotion | ・As a life insurance company, we will address the challenges of health promotion and welfare. | |

| Revitalization of Human Resources/Higher Engagement | ・We will address human rights issues and the leverage of human capital, including diversity. | |

| Support for a Quality of Life | ・We will provide medium- to long-term funding for the development of social infrastructure and the growth of regional economies. |

【Responsible Investment Report】

Please see the report for more information.

Responsible Investment ReportESG Investment

ESG investment takes into account non-financial information including ESG factors as well as

financial information. We focus on (1) ESG integration, (2) ESG thematic investment, (3) Impact investment, and (4) Negative screening.

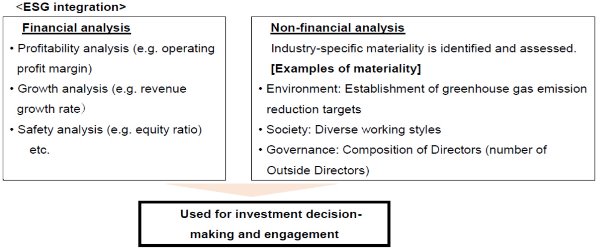

[Method 1] ESG integration: A

method that incorporates ESG perspectives in addition to

quantitative financial

information in the investment decision-making process. As non-financial

information including ESG initiatives impacts the corporate value of investees

in the medium to long term, we assess them upon identifying material ESG issues

(“materiality”) by industry for stocks and credit assets (bonds and loans).

We have implemented ESG integration for all assets since FY 2021.

<ESG integration>

[Method 2] ESG thematic investment: We study and invest in bonds and other assets aimed at solving ESG issues not only to gain investment returns but also to contribute to achieving the SDGs. Assets covered are SDGs bonds/loans, renewable energy projects (project financing), infrastructure investment funds, etc.

In the medium-term business plan starting from fiscal 2023, we have set targets for ESG thematic investment and climate solution investment. Climate solution investment refers to investments that are intended to contribute to the mitigation of and adaption to the urgent issue of climate change.

Investment Target

Actual Total

ESG Thematic

Investment

Cumulative total: JPY700 billion

(3-year period from FY2023 to FY2025)

JPY217 billion

(from Apr 2023 to Dec 2023)

Of which, Climate

Solution Investment

Cumulative total: JPY400 billion

(3-year period from FY2023 to FY2025)

JPY142 billion

(from Apr 2023 to Dec 2023)

[Method 3] Impact investment: An investment approach that intends to create social and environmental impact alongside monetary return. Specifically, the requirements are the intentionality, financial returns, a variety of asset classes, and social impact measurement and management.

financial information. We focus on (1) ESG integration, (2) ESG thematic investment, (3) Impact investment, and (4) Negative screening.

quantitative financial information in the investment decision-making process. As non-financial

information including ESG initiatives impacts the corporate value of investees in the medium to long term, we assess them upon identifying material ESG issues (“materiality”) by industry for stocks and credit assets (bonds and loans).

Investment

(3-year period from FY2023 to FY2025)

(from Apr 2023 to Dec 2023)

Solution Investment

(3-year period from FY2023 to FY2025)

(from Apr 2023 to Dec 2023)

| Major projects | Related SDGs Items※1 |

|---|---|

◆Investment in microfinance fund We invested in the Japan ASEAN Women Empowerment Fund which was formed to support women’s entrepreneurship in ASEAN countries by extending investments and loans to microfinance institutions. (September 2019, etc.) |

|

◆Investment in renewable energy |

|

◆Investment in listed equity fund We invested in the Global Sustainable Equity Open Investment Trust, a fund investing in companies that actively promotes sustainability over the medium to long term. (July 2022) |

|

◆Investment in PE fund specializing in decarbonization We invested in a private equity fund "Energy Environment Investment Fund 5 Innovation and Impact Investment." Through this investment, we aim to both create social impact, such as the spread of renewable energy and progress in energy conservation and earn financial returns through the growth of the startup companies. (March 2023) |

※1 The above SDG logos represent the main goals to which Sumitomo Life believes it contributes through its investment activities.

[Method 4] Negative screening: A method to exclude specific industries and uses of proceeds from the scope of investments. We prohibit investments as follows:

- Companies or projects that cause child labor, forced labor, or human trafficking

- Manufacturers of certain weapons (biological and chemical weapons, anti-personnel landmines, cluster munitions, nuclear weapons, specific conventional weapons)

- Coal, oil or gas related projects※2

※2 Excludes projects that are in line with our transition criteria.

Stewardship activities

We believe that

constructive engagement, or purposeful dialogue that takes sustainability into

consideration will lead to an increase in corporate value and the sustainable

growth of investees,

which in turn will contribute to expanding investment

returns over the medium- to long-term.

Therefore, we endorsed the Principles

for Responsible Institutional Investors (Japan’s Stewardship

Code) and actively

engage in stewardship activities to fulfill our stewardship responsibilities.

For more information, see the following documents:

Basic Principles on Responsible Investment (Attachment)

【PRI Annual Assessment Results for 2023】

The PRI receives annual reports on responsible investment initiatives from member institutions and evaluates the content of these initiatives.

The evaluation results for fiscal 2022 turned out in December 2023 as below.

| Item | Outline | Assessment | |

|---|---|---|---|

| Policy, Governance and Strategy | Policies, governance, and strategies for responsible investment and stewardship activities | ★★★★★ (5 stars) |

|

| Confidence Building Measures | Review of reported data, third-party assurance, etc. | ★★★★★ (5 stars) |

Governance

Governance

From fiscal 2021, Sumitomo Life established a responsible investment structure under the

supervision of the Responsible Investment Team of the Investment Planning Department, and

appropriately implements the PDCA cycle through the framework of the Responsible Investment

Committee (※4) and the Responsible Investment Meeting. (※5) We are also working to improve our

responsible investment by making use of annual assessment results based on the PRI and the

frameworks and expertise of external initiatives.

※4 The Committee is composed of

outside experts and was reorganized from the former Third-party Committee

Regarding Stewardship

Activities.

※5 Newly established as a meeting

body to discuss and improve the level of responsible investment activities

throughout the asset

investment division.

External Initiatives

External Initiatives

Task Force on Climate-Related Financial Disclosures |

・A private sector-led task force established by the Financial Stability Board (FSB) in December 2015. In June 2017, TCFD released its final report (TCFD recommendations) providing a framework for companies’ voluntary disclosure of information regarding climate-related risks and opportunities ・Sumitomo Life announced the endorsement of the TCFD recommendations in March 2019. |

|---|---|

Principles for Responsible Investment |

・A set of investment principles launched by the United Nations in 2006 that calls for institutional investors to incorporate ESG perspectives into their investment decision-making processes. ・Sumitomo Life signed the PRI in April 2019. |

Climate Action100+ |

・An initiative to seek the reduction of greenhouse gas emissions through engagement with companies.

・Sumitomo Life signed the initiative in December 2020. |

CDP |

・An initiative to encourage major companies around the world to disclose information on climate change, water, forests, etc., and to engage in collaborative engagement. Launched in 2000. ・Sumitomo Life signed the CDP in December 2020. |

PCAF |

・A global partnership of financial institutions launched in 2019,working to develop and implement a standardized approach to assess and disclose the greenhouse gas emissions associated with loans and investments. ・Sumitomo Life joined PCAF in September 2021. |

JSI |

・An initiative established for considering countermeasures for practical issues across industries and sharing best practices from the perspective of the development of stewardship activities. ・Sumitomo Life joined JSI in November 2019. |

| Net-Zero Asset Owner Alliance (AOA) |

・An international initiative that aims to achieve the Paris Agreement's goal of limiting temperature rise to 1.5°C through the cooperation of asset owners. Under the

leadership of the United Nations Environment Programme Finance Initiative (UNEP

FI) and the Principles for Responsible Investment (PRI), the AOA has been active

since 2019. ・Sumitomo Life joined AOA in October 2021. |

| Japan Impact-driven Financing Initiative |

・A Japanese initiative launched in November 2021 to promote the practice and promotion of impact investment by financial institutions that seek to resolve environmental and social issues through investment activities. ・Sumitomo Life joined the Initiative in April 2022. |

Task Force on Nature-Related Financial Disclosures Forum |

・Organizations that support TNFD's activities that formulate frameworks for biodiversity. ・Sumitomo Life joined the TNFD Forum in September 2022. |

Advance |

・The Advance is a five-year project

launched in May 2022 under the leadership of the PRI (Principles for Responsible

Investment) and is an initiative in which institutional investors encourage companies to resolve

social issues, mainly related to human rights, through collaborative

engagement. ・Sumitomo Life signed on the Advance as an “Endorser” to support the activities of the initiative in December 2022. |

Spring |

・An international initiative led by the PRI announced at the "PRI in Person" annual meeting in October 2023.It focuses on issues such as deforestation in natural capital and biodiversity conducts collaborative engagement to support corporate initiatives to solve these issues. ・Sumitomo Life signed on the Spring as an “Endorser” to support the activities of the initiative in February 2024. |

Nature Action 100 |

・An international initiative announced at COP15 held in December 2022. It identifies 100 global companies with a high dependence on natural capital and conducts collaborative engagement to support their initiatives on key items such as targets and governance for natural capital and biodiversity. ・Sumitomo Life joined the Initiative in February 2024. |