Asset Management

Sumitomo Life manages assets with safety and security in mind so that we can continue to reliably pay insurance claims and benefit payments to our customers into the future. As the existence of a sustainable society is a prerequisite, we engage in asset management that takes into account sustainability over the medium to long term, including ESG (Environment, Social and Governance) factors (responsible investment).

Safe and Secure Asset Management

Sumitomo Life applies Asset and Liability Management (ALM) considering the long-term characteristics of life insurance liabilities. Our basic policy is to secure stable earnings while controlling risks appropriately by investing mainly in long-term interest-bearing assets including public and corporate bonds and loans under ALM. Furthermore, we aim to sustainably improve corporate value by managing stocks and other risk assets within an acceptable risk amount.

Sumitomo Life Group's Initiatives under "Policy Plan for Promoting Japan as a Leading Asset Management Center"

Please refer here ![]() for details.

for details.

Responsible Investment Initiatives

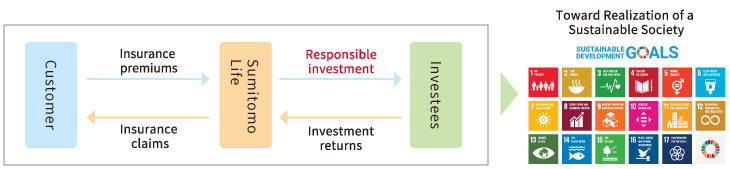

We promote asset management that takes sustainability into consideration (responsible investment) with the aim of securing stable investment returns over the medium to long term and contributing to the realization of a sustainable society. We believe that contributing to the realization of a sustainable society is an initiative in line with our purpose and also contributes to securing medium to long term investment opportunities and reducing investment risks in our asset management. We will continue to make further contributions to solving social and environmental issues by promoting responsible investment.

Basic Principles on Responsible Investment

This shows our stance on responsible investment. We promote responsible investment guided by these basic principles.

Basic Principles on Responsible Investment

Conceptual Diagram

Purpose of Responsible Investment

Actions

Responsible investment specifically refers specifically to ESG investment and stewardship activities.

| ESG Investment | Stewardship Activities |

|---|---|

|

|

Domains of Contribution to Well-being

As an institutional investor, Sumitomo Life is committed to domains of contribution to well-being as indicated in "Sumitomo Life Group Vision 2030." The areas we focus on are listed below. We believe that by investing in these areas, we will also contribute to the growth of our business partners.

| Domains of Contribution to Well-being | Description | Related SDGs |

|---|---|---|

| Improving the Global Environment |

|

|

| Contributing to Health Promotion |

|

|

| Revitalizing Human Capital and Raising Engagement |

|

|

| Supporting Fulfilling Lifestyles and all Generations |

|

|

Responsible Investment Reports

Please refer here for our policy and activities related to responsible investment.

2025 Responsible Investment Report

2024 Responsible Investment Report

2023 Responsible Investment Report

2022 Responsible Investment Report

2021 Responsible Investment Report

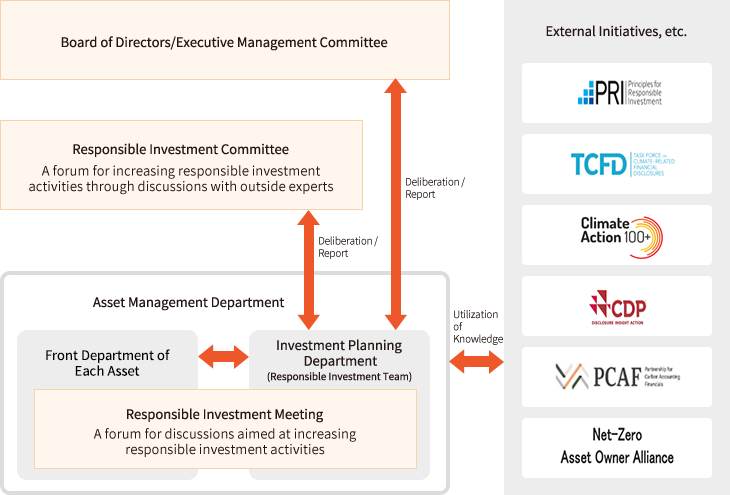

Governance Structure

Since FY 2021, Sumitomo Life has established a responsible investment structure under the supervision of the Responsible Investment Team of the Investment Planning Department, and appropriately implements the PDCA cycle within the framework of the Responsible Investment Committee*1 and Responsible Investment Meeting*2. We are also working to improve our responsible investment by making use of annual assessment results based on the PRI and the frameworks and expertise of external initiatives.

- *1The conference body whose members are external experts, and it has been restructured from the previous "Third-Party Committee on Stewardship Activities."

- *2Newly established as a forum for discussing and raising the level of responsible investment activities across the entire asset management division.

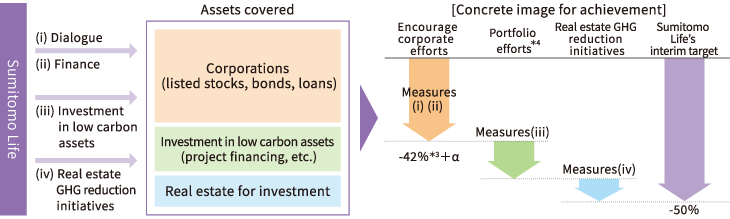

Initiatives to Achieve a Decarbonized Society

We aim to meet our targets through various initiatives to reduce greenhouse gas emissions in our asset portfolio.

- *3This figure is based on the Japanese government's effort target of -50% (compared to FY2013), which has been rewritten to the FY2019 standard.

- *4Effect due to the improvement of the asset portfolio

| Measures | Outline of Initiatives |

|---|---|

| (i) Dialogue |

|

| (ii) Finance |

|

| (iii) Investment in Low Carbon Assets |

|

| (iv) Real Estate GHG Reduction Initiatives |

|

- *5This financing method is designed to support the efforts of companies that are steadily working to reduce GHG emissions in accordance with their long-term strategies toward the realization of a decarbonized society.

ESG Investment

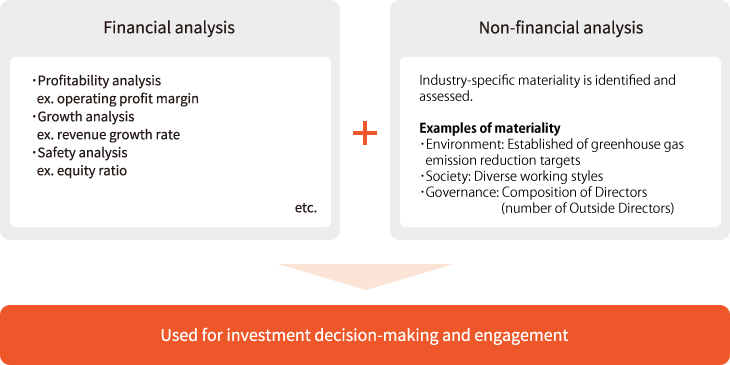

ESG investment takes into account non-financial information including ESG factors as well as financial information. We focus on (i) ESG integration, (ii) ESG thematic investment, (iii) Impact investment and (iv) Negative screening.

Method (i) ESG Integration: A method that incorporates ESG perspectives in addition to quantitative financial information in the investment decision-making process. As non-financial information including ESG initiatives impacts the corporate value of investees in the medium to long term, we assess them upon identifying material ESG issues ("materiality") by industry for stocks and credit assets (bonds and loans).

We have implemented ESG integration for all assets.

Overview of ESG Integration

Method (ii) ESG Thematic Investments: Investment in bonds and other instruments aimed at resolving ESG issues. Investment is evaluated and executed based on a consideration of the contribution to attainment of SDGs, as well as the return on investment. Assets in scope include SDG bonds and loans, renewable energy projects (project financing), and infrastructure investment funds.

In the three-year Medium-Term Business Plan that started from FY2023, we have set targets for ESG thematic investment and climate solution investment. Climate solution investment refers to investments that are intended to contribute to the mitigation of and adaption to the urgent issue of climate change.

Particularly regarding transition finance, it often results in financing for GHG high emitting companies, which may cause a temporary increase in GHG emissions in our asset portfolio. However, we are proactively involved in transition finance in order to encourage investees to work to reduce emissions over the medium to longer term.

| Target | Results | |

|---|---|---|

| ESG Thematic Investments | Cumulative: ¥1 trillion (3-year total for FY2023-2025) | Cumulative: ¥1,085.0 billion (Apr 2023-Nov 2025) |

| Of which, climate finance | Cumulative: ¥500.0 billion (3-year total FY2023-2025) | Cumulative: ¥506.2 billion (Apr 2023-Nov 2025) |

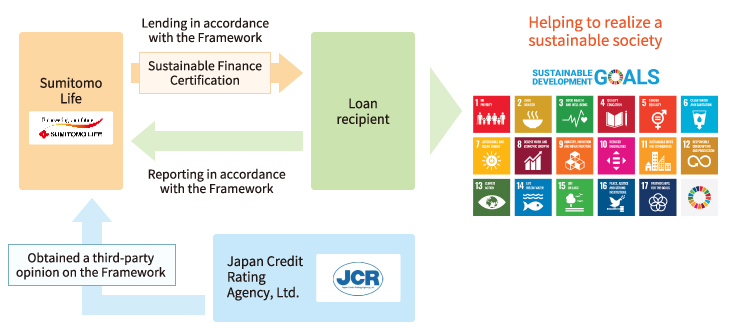

In March 2024, we established and published the Sumisei Sustainable Finance Framework to help create even more positive impact. The framework aims to meet corporate need for funding to promote sustainability initiatives from a financing perspective. It also accords with international guidelines and has a third-party appraisal from the Japan Credit Rating Agency.

Overview of the Framework

Initiatives within the Framework

| Framework | Descriptions |

|---|---|

| Green Loans | Loans used only for green projects with clear environmental benefits. |

| Sustainability-linked Loans | Sustainability performance targets are set, and loan terms are modified according to the achievement of these targets. Loan proceeds are not tied to specific projects. |

| Transition Loans | Loans to companies/projects that are working to reduce GHG emissions in accordance with a long term strategy to achieve a decarbonized society. Transition strategies and eligibility of use of proceeds are assessed. |

- *For details, please refer to the third-party opinion at the following URL:

https://www.jcr.co.jp/download/c7e1d620197559125f52591580f0e57e5752d28f570f72e2ee/23d1816.pdf (Japanese only) - *Please refer to the following for our past initiatives and achievements. https://www.sumitomolife.co.jp/english/assetmanagement/file/SSFF202512.pdf

Method (iii) Impact Investment: An investment approach that intends to create social and environmental impact alongside monetary return. Specifically, the requirements are the intentionality, financial returns, a variety of asset classes, and social impact measurement and management.

Case Study: Investment in Fund Formed by Keio Innovation Initiative

- Name: KII No. 3 Impact Investment Limited Partnership

- Investment: ¥1.0 billion

- Timing: August 2024

- Invests mainly in medical and health as well as digital technology and aims to generate both social impact and returns on investment.

- *For details, please refer to Sumitomo Life's news release dated August 13, 2024 (Japanese only).

Case Study: Investment in Fund Formed by BlackRock

- Name: Global Renewable Power Fund IV

- Investment: ¥14.2 billion

- Timing: December 2023

- In addition to financial returns, the fund aims to create the social impacts of lowering greenhouse gas emissions through the use of renewable energy, reducing water usage, and increasing employment related to the construction and operation of related facilities.

- *For details, please refer to Sumitomo Life's news release dated December 22, 2023 (Japanese only).

Case Study: Investment in Fund Formed by Energy & Environment Investment, Inc.

- Name: EEI Fund 5 Innovation and Impact Investment

- Investment: ¥1.5 billion

- Timing: March 2023

- In addition to financial returns, the fund aims to create social impact through the uptake of renewable energy and advances in lower energy consumption.

- *For details, please refer to Sumitomo Life's news release dated March 17, 2023 (Japanese only).

Method (iv) Negative screening: A method to exclude specific industries and uses of proceeds from the scope of investments. We prohibit investments as follows:

- *For details, please refer to Appendix 1 of the "Basic Principles on Responsible Investment: Policy on initiatives in sectors with high social and environmental risks

.

.

- Investment in companies or projects that cause child labor, forced labor, or human trafficking

- Investment in companies or projects that manufacture specific weapons (cluster munitions, biological weapons, chemical weapons, anti-personnel landmines, nuclear weapons, etc.).

- Investment in coal, oil, or gas related projects*6

- *6However, this does not include projects that the company judges to contribute to the transition to decarbonization.

Stewardship Activities

We actively engage in stewardship activities (dialogue and exercise of voting rights) based on the underlying objective of the Principles for Responsible Institutional Investors (Japan's Stewardship Code), namely promoting sustainable growth as well as enhancement of corporate value of the investees through dialogue.

Dialogue

We work to develop a shared awareness with investees and urge them to resolve issues through dialogue aimed at encouraging them to improve their corporate value over the medium to longer term. Since companies' management-related and ESG-related issues and solutions vary depending on characteristics such as size and growth stage, our basic stance for dialogue is to communicate our concerns and requests as an investor based on our individual company analysis and work to deepen the understanding of related themes. We will continue to pursue dialogue on important themes such as companies' measures against global warming, as well as human rights and labor environment issues, human capital, and biodiversity.

Viewpoints for Dialogue

| Themes | Main Viewpoints for Dialogue |

|---|---|

| Management Strategy / Business Strategy |

|

| Capital Efficiency / Shareholder Returns |

|

| ESG |

Environmental & Social

Governance

|

Exercising Voting Rights

We have established "Guidelines for Exercising Voting Rights" from the viewpoint of improving corporate value over the medium to long term and deciding how to vote on a proposal, taking into account the nature of dialogue and efforts to address issues. We revise the "Guidelines for Exercising Voting Rights" as necessary, based on factors such as broader ESG discussions.

Company‘s criteria for exercising voting rights

Guidelines for Exercising Voting Rights and Philosophy (Revised September 25) (Japanese only)

Regarding Inquiries About Our Shareholding Status

When we receive inquiries from investee companies regarding our shareholding status, we will explain the status and strive to promote constructive dialogue with them. Please note that explanations of our shareholding status are limited to investee companies only, and, as a general rule, we provide the number of shares held by us as of the end of the previous month.

- *Effective from October 1, 2025, JST.

External Assessment (PRI)

PRI Evaluation Results (FY2023 Review*7)

We obtained a PRI (Principles for Responsible Investment) assessment for our initiatives related to responsible investment in FY2023. The overview of the results of the assessment is presented below. We intend to raise the level of our responsible investment based on the results.

| Item | Outline | Assessment |

|---|---|---|

| Policy, Governance and Strategy | Policies, governance, and strategies for responsible investment and stewardship activities | ★★★★★ |

| Confidence Building Measures | Review of reported data, third-party assurance, etc. | ★★★★★ |

- *7We obtained the result of assessment in November 2024 for our initiatives in FY 2023

Adobe Acrobat, available for free from Adobe Systems, is required to view PDF files.